How To Calculate Unit Price Of A Fund

In other words one MF units price will be equal to that funds net value divided by the number of outstanding shares. We take the fund value for each of our unitlinked funds and divide this figure by the number of units within the fund to obtain a unit price.

The Secrets Of Investing In Unit Trust Kclau Com Investing Finance Blog Finance

Unit price 638 2 lbs.

How to calculate unit price of a fund. Many mutual funds use this. The Redemption Price per Unit will be calculated using the following formula. 10- and the investor receives 1000010 1000 units.

To standardize the value of assets to every unit this value is then divided by the total number of outstanding units to yield the net asset value. The per-share value of a portfolio is referred to as Net Asset Value NAV sometimes denoted as Net Asset Value per share NAVPS. Updated March 17 2021.

Next determine the total units. Understanding unitlinked funds 05 We normally calculate the value of our funds each working day. An investor invests Rs.

The easiest way to find out the price of a mutual fund is to look at its net asset value. Start by converting 32 ounces to pounds. Lets assume you have invested in a Unit Trust a sum of Rs 100000- at a unit selling price of Rs10- per unit on 1st January 2008.

We then calculate a unit price for each fund based on the valuation of all the assets within it. The total value figure is important to investors because it is from here that the price per unit of a fund can be calculated. Before we learn the formula for calculating NAV we must understand what total asset value and expense ratio are.

Check the value of your super To work out how much your super is worth multiply the number of units you have in an investment option by its daily unit price. The price you see in Sharesies for managed funds is the most recent mid-price weve received from the fund manager and will always be at least one day old. Unit price 319 per lb.

A funds unit price is determined through its net asset value or the funds assets subtracted by its liabilities while a companys stock price is based on business and market conditions. Net asset value along with any dividends you receive from your investment will impact. As a new investor you may see the phrase net asset value NAV next to your favorite mutual fund when you go to buy or sell shares.

BRedemption Price for each Option will be calculated on the basis of Applicable NAV and Exit load if any. 10- then the purchase price will be Rs. Outstanding share represents the number of units of a mutual fund.

A manager of retail financial asset funds may calculate and publish many hundreds of unit prices every business day. By dividing the total value of a fund by the number of outstanding. Lets also assume this Unit.

Mutual funds use the NAV to represent the unitper shareprice of owning a share of the fund. Key findings of joint review into unit pricing 1. Calculate the total quantity of units produced in the lot.

Mid-price transaction fee Buy price. 10000- and the current NAV is Rs. Determine the total price of the entire lot of product.

Next calculate the unit price using the formula above. Fees are also set by the fund manager. The mid-price is adjusted by the funds transaction fee to create the buy and sell price.

32 oz 16 2 lbs. First determine the total price. The unit price changed over time and the unit buying prices recorded were Rs12- 15- and 18- at the end of 2008 2009 and 2010 respectively.

Definition of Unit Price A mutual funds NAV is the market value of the fund. NAV is the total value of a mutual funds assets less all of its liabilities. For example lets find the unit price per pound for a quantity of 32 ounces at a price of 638.

Number of units x Daily unit price Value of your super. Unit prices may be calculated under intense pressure Unit prices are often calculated in a high-speed high-pressure environment. To calculate NAV the overall expense ratio is subtracted from the asset value.

As the unit price changes so does the overall value of your investment.

What Are Etf S Stock Exchange Investing Trading

Fixed Cost Formula Calculator Examples With Excel Template

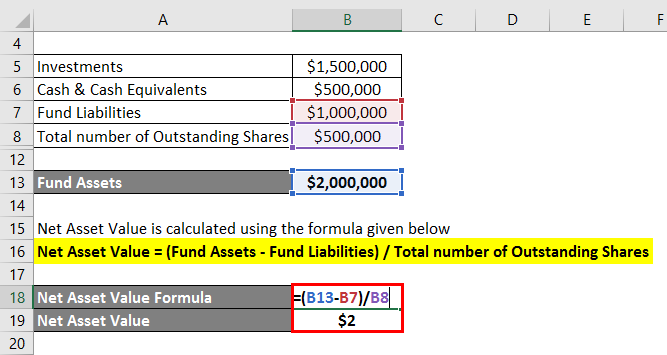

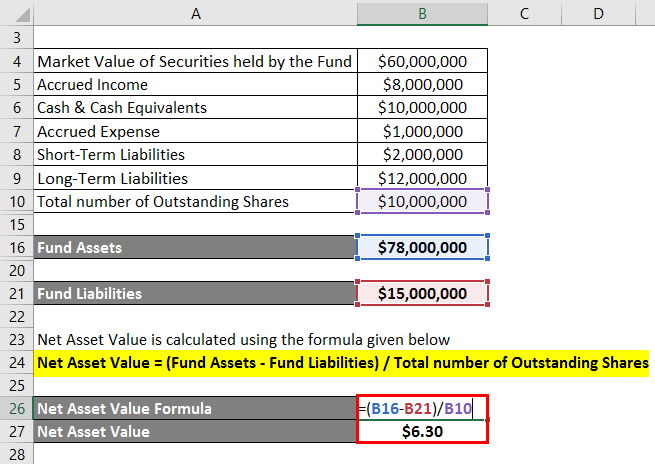

Net Asset Value Formula Calculator Examples With Excel Template

/latex_9e2c1ac6ab137d491840c617b8949346-5c5069e2c9e77c0001d7bce5.jpg)

Total Expense Ratio Ter Definition

Net Asset Value Formula Calculator Examples With Excel Template

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Capital Gains Tax

Nav Definition Importance Of Net Asset Value In Mutual Funds Mutuals Funds Fund Mutual

Weighted Average Price Calculator Plan Projections Price Calculator Weighted Average How To Plan

Methods Of Depreciation Learn Accounting Method Fixed Asset

How Idfc Mutual Fund Nav Is Calculated Mutuals Funds Fund The Unit

Financial Literacy Understanding Calculating Compound Interest Personal Finance Money Management Advice Compound Interest Math Finance

How To Calculate Weighted Average Price Per Share Fox Business

Net Asset Value Formula Calculator Examples With Excel Template

Working Capital Needs Calculator Plan Projections Business Planner Business Planning Finance Planner

How To Calculate The Net Asset Value 11 Steps With Pictures

How To Calculate Long Term Capital Gain Tax On Equity Shares And Mutual Fund From 1st April 2018 Capital Gains Tax Capital Gain Mutuals Funds

How To Calculate The Net Asset Value 11 Steps With Pictures

Access Denied Growth Fund Value Investing